Welcome to our comprehensive guide on Bitcoin halving, one of the most critical events on Bitcoin’s blockchain.

In this article, we will explore the concept of Bitcoin halving in detail, breaking down its significance, impact, and historical context. By the end of this post, you’ll have a solid understanding of what Bitcoin halving is and why it matters as we explore what it is, how it works, and the effects it has on the Bitcoin ecosystem.

Whether you’re an experienced crypto enthusiast or just beginning to dive into the world of cryptocurrencies, this post will provide you with valuable insights into one of Bitcoin’s most intriguing phenomena.

Before we plunge into the details of Bitcoin halving, let’s start with a quick refresher on what Bitcoin is and the underlying technology behind it. Bitcoin is a decentralized digital currency that operates on a technology called blockchain. This technology allows for secure and transparent transactions without the need for intermediaries like banks or governments.

Now, let’s embark on a journey to understand the intricacies of Bitcoin halving, uncovering the mechanics behind this event and exploring its historical significance. By the end of this article, you’ll gain a comprehensive understanding of Bitcoin halving and its impact on the ever-evolving landscape of cryptocurrency.

What is Bitcoin Halving?

Bitcoin has a finite supply, which makes it a scarce digital commodity. The total amount of Bitcoin that will ever be issued is 21 million.

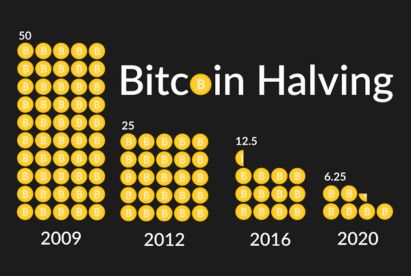

Bitcoin halving is a pivotal event that occurs approximately every four years as part of the Bitcoin protocol. The halving event decreases the number of total bitcoins generated per block by 50% every four years.

It refers to the reduction in the rate at which new Bitcoins are generated and added to the blockchain. The halving process is programmed into the Bitcoin code and serves as a built-in mechanism to control the supply of Bitcoin over time.

The Mechanics Behind Bitcoin Halving:

To grasp the mechanics of Bitcoin halving, let’s take a closer look at the mining process. Bitcoin operates on a proof-of-work consensus algorithm, where miners compete to solve complex mathematical problems in order to validate transactions and add them to the blockchain. In return for their efforts, miners are rewarded with newly minted Bitcoins.

Initially, when Bitcoin was first introduced, the block reward for miners was 50 Bitcoins per block. However, as part of the halving process, this block reward is reduced by half roughly every four years. The first halving occurred in 2012, reducing the block reward to 25 Bitcoins. The second halving took place in 2016, reducing the reward to 12.5 Bitcoins. The most recent halving occurred in 2020, further reducing the reward to 6.25 Bitcoins per block.

Implications of Bitcoin Halving:

- Scarcity and Supply: Bitcoin halving plays a critical role in ensuring the scarcity of Bitcoin. By reducing the rate at which new Bitcoins are produced, halving creates a limited supply, similar to precious metals like gold. This scarcity factor has the potential to drive up the value of Bitcoin over time.

- Mining Rewards: As a result of halving, the mining rewards for miners decrease. This reduction in block rewards can impact miners’ profitability, as they must compete with increased computational power and energy costs. However, it also helps maintain the security and integrity of the Bitcoin network, as miners continue to validate transactions despite the reduced rewards.

- Market Speculation: Bitcoin halving often generates excitement and speculation within the cryptocurrency market. Historically, halving events have been followed by significant price increases in Bitcoin and Altcoins alike. This anticipation and speculation can lead to volatile price fluctuations, making halving a topic of interest for traders and investors.

Historical Significance:

Bitcoin halving events have gained considerable attention due to their historical significance. They mark important milestones in Bitcoin’s journey, reflecting its maturation and adoption by the mainstream. Halving events also serve as a reminder of Bitcoin’s deflationary nature, distinguishing it from traditional fiat currencies that are subject to inflation.

Conclusion:

Bitcoin halving is a fundamental process embedded within the Bitcoin protocol. It ensures the controlled issuance of new Bitcoins, maintains scarcity, and impacts mining rewards and market dynamics. Understanding the mechanics and implications of halving is crucial for anyone interested in Bitcoin and the broader cryptocurrency ecosystem.

As you explore the world of cryptocurrencies, keep an eye out for future halving events, as they continue to shape the trajectory of Bitcoin and its place in the global financial landscape. Stay informed, make educated decisions, and enjoy the exciting journey that awaits in the realm of digital currencies.